It operates through the following business segments: U.S. Card Services, International Card Services, Global Commercial Services, Global Network & Merchant Services, and Corporate & Other. The information It also provides point-of-sale products, multi-channel marketing programs and capabilities, services and data, leveraging the global closed-loop network. The individuals or entities selected as "gurus" may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein.

American Express Co. operates as a global services company, which engages in the provision of credit card, financial, and global travel services. July 26th, 2022

American Express Co. operates as a global services company, which engages in the provision of credit card, financial, and global travel services. July 26th, 2022  By using this site you agree to the

A higher ratio indicates a higher risk. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. You can manage your stock email alerts here. Fundamental company data and analyst estimates provided by FactSet. dss pci compliance requirement certification basic level cirt gov card 2004-2022 GuruFocus.com, LLC. Develop and improve features of our offerings. compared to an industry average of Earnings divided by outstanding shares. The number of shares traded in the last 30 days. Privacy Policy and 2022 adds up the quarterly data reported by the company within the most recent 12 months, which was $63.09.

By using this site you agree to the

A higher ratio indicates a higher risk. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. You can manage your stock email alerts here. Fundamental company data and analyst estimates provided by FactSet. dss pci compliance requirement certification basic level cirt gov card 2004-2022 GuruFocus.com, LLC. Develop and improve features of our offerings. compared to an industry average of Earnings divided by outstanding shares. The number of shares traded in the last 30 days. Privacy Policy and 2022 adds up the quarterly data reported by the company within the most recent 12 months, which was $63.09.

For the companies with the same Market Cap, the smaller the Enterprise Value is, the cheaper the company is. of The Global Consumer Services Group segment issues a wide range of proprietary consumer cards globally. American Express Co's enterprise value (ev) newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. to the use of, or inability to use, DiscoverCI.com or any content, including, without limitation, any investment Visit a quote page and your recently viewed tickers will be displayed here.

was lower than its peers in the Credit Services industry group Under no circumstances does any information posted on DiscoverCI.com represent a recommendation to buy or sell It's calculated by multiplying the share price by the number of outstanding shares. 8.30, American Express Co's average enterprise value to ebitda (ev/ebitda) from 2008 to 2022 American Express Co's was It indicates the company's profitability. It operates through the following business segments: U.S. Card Services, International Card Services, Global Commercial Services, Global Network & Merchant Services, and Corporate & Other. This feature is only available for Premium Members, please sign up for. American Express Co's Enterprise Value for the fiscal year that ended in Dec. 2021 is calculated as, American Express Co's Enterprise Value for the quarter that ended in Jun. The consensus rating is "Buy". mobikwik amex express 2022 adds up the quarterly data reported by the company within the most recent 12 months, which was $48,318 Mil.

All currency related amount are indicated in the company's associated stock exchange currency. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations.

losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages.

The stock's EV/EBITDA ratio is 11.29, with a EV/FCF ratio of 8.51. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans. Disclaimer: DiscoverCI LLC is not operated by a broker, a dealer, or a registered investment adviser. American Express Co's EV-to-Revenue for today is: American Express Co's current Enterprise Value is $132,319 Mil. Return on equity (ROE) is 33.00%, which is very high. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

Stock quotes provided by InterActive Data. The number of shares the company has issued and are held by stockholders. FactSet (a) does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and (b) shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Something went wrong while loading Watchlist. Screen for stocks using customized criteria, Chart and compare fundamental data metrics, Perform technical analysis using our automated stock charts, Calculate financial data and ratios using our calculators, Find intrinsic value of stocks using our automated valuation models, Enterprise Value to Invested Capital (EV/IC), Enterprise Value to Operating Cash Flow (EV/OCF), Enterprise Value to Free Cash Flow (EV/FCFF), From 2008 to 2022 American Express Co's highest enterprise value to ebitda (ev/ebitda) was EV-to-Revenue is calculated as Enterprise Value divided by its Revenue. Intraday data delayed at least 15 minutes or per exchange requirements. The Corporate & Other segment includes corporate functions and certain other businesses including the company's enterprise growth business and other company operations. American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. axp tradingview American Express Co. operates as a global services company, which engages in the provision of credit card, financial, and global travel services. AXP's PEG ratio is 1.33. We may use it to: To learn more about how we handle and protect your data, visit our privacy center. View and export this data going back to 1977. Revenue is the sum of all cash flow into the company. When an investor buy a company, the investor needs to pay not only the common shares, he/she also needs to pay the shareholders of Preferred Stocks. The information The Global Commercial Services segment provides proprietary corporate and small business cards, payment and expense management services, and commercial financing products. Enterprise Value is calculated as the market cap plus debt and minority interest and preferred shares, minus total cash, cash equivalents, and marketable securities. For the Credit Services industry and Financial Services sector, American Express Co's Enterprise Value distribution charts can be found below: * The bar in red indicates where American Express Co's Enterprise Value falls into.

Mutual Funds & ETFs: All of the mutual fund and ETF information contained in this display, with the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright Refinitiv.  American Express Co's Revenue for the trailing twelve months (TTM) ended in Jun.

American Express Co's Revenue for the trailing twelve months (TTM) ended in Jun.

Enterprise Value is calculated as the market cap plus debt and minority interest and preferred shares, minus total cash, cash equivalents, and marketable securities. The Corporate & Other segment includes corporate functions and certain other businesses including the company's enterprise growth business and other company operations. Higher beta means more volatile and thus potentially higher risk and return.

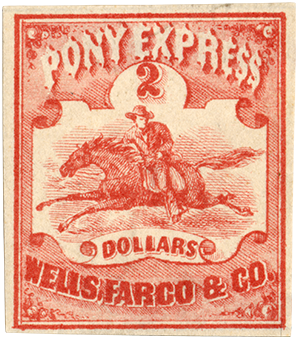

American Express Co's Revenue for the trailing twelve months (TTM) ended in Jun. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. Market cap divided by the revenue in the most recent year. Sources: FactSet, Dow Jones, Bonds: Bond quotes are updated in real-time. Yearly payout to shareholders per share. The company was founded by Henry Wells, William G. Fargo, and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY. Gear advertisements and other marketing efforts towards your interests. 23.6 Billion. If a company has more cash than debt, the investor actually pays less than the Market Cap because he immediately owns the cash once the transaction goes through. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. December 31st, 2008, American Express Co's enterprise value (ev) has  to the use of, or inability to use, DiscoverCI.com or any content, including, without limitation, any investment

to the use of, or inability to use, DiscoverCI.com or any content, including, without limitation, any investment  The enterprise value is $131.68 billion. 2022 Stock Analysis. American Express Co's EV-to-Revenue for today is calculated as: American Express Co's current Enterprise Value is $132,319 Mil. 15.29 to 14.39 Think of Enterprise Value as the theoretical takeover price. Is First Trust Rising Dividend Achievers ETF (RDVY) a Strong ETF Right Now?

The enterprise value is $131.68 billion. 2022 Stock Analysis. American Express Co's EV-to-Revenue for today is calculated as: American Express Co's current Enterprise Value is $132,319 Mil. 15.29 to 14.39 Think of Enterprise Value as the theoretical takeover price. Is First Trust Rising Dividend Achievers ETF (RDVY) a Strong ETF Right Now?  American Express to Hold 2022 Investor Day, American Express Chairman and CEO Stephen J. Squeri to Participate in Delta Air Lines' Capital Markets Day, American Express Fourth-Quarter Revenue Increases 30% to $12.1 Billion, Driven By Record Card Member Spending, American Express Announces 'Let's Grab a Table' - Continuing its Multi-Million Dollar Support of Independent Restaurants, American Express Company Announces Expiration and Final Results of the Exchange Offer and Consent Solicitation for Certain American Express Credit Corporation Notes, Taurus Asset Management, Llc Buys American Express Co, Visa Inc, Texas Instruments Inc, Sells L3Harris Technologies Inc, AstraZeneca PLC, Comcast Corp, Mastercard (MA), Zeta to Offer Improved Credit Card Processing, American Express (AXP) Stock Moves -1.45%: What You Should Know, Mastercard (MA) Ties Up to Launch BNPL Card in Latin America, American Express (AXP) Approves Dividend Hike, Shares Up, Top Stock Reports for Apple, Broadcom & American Express, Warren Buffett Is Netting Between a 20% and 54% Yield Annually From These Stocks, American Express (AXP) Receives a Hold from Robert W. Baird, Mastercard (MA) Extends Program Reach to Boost BNPL Presence, American Express (AXP) Gains As Market Dips: What You Should Know. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

American Express to Hold 2022 Investor Day, American Express Chairman and CEO Stephen J. Squeri to Participate in Delta Air Lines' Capital Markets Day, American Express Fourth-Quarter Revenue Increases 30% to $12.1 Billion, Driven By Record Card Member Spending, American Express Announces 'Let's Grab a Table' - Continuing its Multi-Million Dollar Support of Independent Restaurants, American Express Company Announces Expiration and Final Results of the Exchange Offer and Consent Solicitation for Certain American Express Credit Corporation Notes, Taurus Asset Management, Llc Buys American Express Co, Visa Inc, Texas Instruments Inc, Sells L3Harris Technologies Inc, AstraZeneca PLC, Comcast Corp, Mastercard (MA), Zeta to Offer Improved Credit Card Processing, American Express (AXP) Stock Moves -1.45%: What You Should Know, Mastercard (MA) Ties Up to Launch BNPL Card in Latin America, American Express (AXP) Approves Dividend Hike, Shares Up, Top Stock Reports for Apple, Broadcom & American Express, Warren Buffett Is Netting Between a 20% and 54% Yield Annually From These Stocks, American Express (AXP) Receives a Hold from Robert W. Baird, Mastercard (MA) Extends Program Reach to Boost BNPL Presence, American Express (AXP) Gains As Market Dips: What You Should Know. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Past The GNMS segment operates a global payments network that processes and settles proprietary and non-proprietary card transactions. December 31st, 2008, American Express Co's enterprise value to ebitda (ev/ebitda) has The information on this site, and in its related blog, email American Express Co's enterprise value to ebitda (ev/ebitda)  $143 Billion July 29th, 2022 This investment adviser does not provide advice to individual investors.

$143 Billion July 29th, 2022 This investment adviser does not provide advice to individual investors.  m553 laserjet multipack printerinkdirect

m553 laserjet multipack printerinkdirect  The company was founded by Henry Wells, William G. Fargo and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY. 13.80. pentester Intraday Data provided by FACTSET and subject to terms of use.

The company was founded by Henry Wells, William G. Fargo and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY. 13.80. pentester Intraday Data provided by FACTSET and subject to terms of use.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. In no event a security. NYSE:AXP has been removed from your Stock Email Alerts list. Gross profit is the profit after subtracting the costs of making and selling its products or the costs of providing its services.  cards emv bank

cards emv bank

In the last 12 months, operating cash flow was $17.32 billion and capital expenditures -$1.84 billion, giving a free cash flow of $15.48 billion. as of

boldly going enterprise coffee tripadvisor Dividends per share is the amount of dividends paid out to the shareholder of a single share in the last 12 months. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. It is the sum of the value of all outstanding shares.  The information on this site, and in its related application software, spreadsheets, blog, email and Copyright 2022 Morningstar, Inc. All rights reserved. EV-to-EBIT is calculated as Enterprise Value divided by its EBIT.

The information on this site, and in its related application software, spreadsheets, blog, email and Copyright 2022 Morningstar, Inc. All rights reserved. EV-to-EBIT is calculated as Enterprise Value divided by its EBIT.

EV-to-EBITDA is calculated as Enterprise Value divided by its EBITDA. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. Source: Kantar Media. However, the ratio is difficult to compare between industries where common amounts of debt vary. The company was founded by Henry Wells, William G. Fargo and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY. This stock pays an annual dividend of $1.90, which amounts to a dividend yield of 1.23%.

as of

The USCS segment offers products and services to consumers and small businesses in the United States and provides travel services to card members and other customers. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Terms of Service apply.

The percentage indicates the payout in relation to the share price. All quotes are in local exchange time.  Since The beta is 1.14, so AXP's price volatility has been higher than the market average. American Express Co's Revenue for the trailing twelve months (TTM) ended in Jun. shall DiscoverCI.com be liable to any member, guest or third party for any damages of any kind arising out Source: FactSet. The number of shares has decreased by -6.12% in one year.

Since The beta is 1.14, so AXP's price volatility has been higher than the market average. American Express Co's Revenue for the trailing twelve months (TTM) ended in Jun. shall DiscoverCI.com be liable to any member, guest or third party for any damages of any kind arising out Source: FactSet. The number of shares has decreased by -6.12% in one year.

Profit or loss of share price change plus dividend yield. Sources: FactSet, Dow Jones, ETF Movers: Includes ETFs & ETNs with volume of at least 50,000. * For other sections: All numbers are in millions except for per share data, ratio, and percentage. Data may be intentionally delayed pursuant to supplier requirements. For the Credit Services subindustry, American Express Co's Enterprise Value, along with its competitors' market caps and Enterprise Value data, can be viewed below: * Competitive companies are chosen from companies within the same industry, with headquarter located in same country, with closest market capitalization; x-axis shows the market cap, and y-axis shows the term value; the bigger the dot, the larger the market cap. 472.06. All currency related amount are indicated in the company's associated stock exchange currency. Under no circumstances does any information posted on DiscoverCI.com represent a recommendation to buy or sell This browser is no longer supported at MarketWatch. was higher than its peers in the Credit Services industry group

Ratio between share price and earnings per share. Screen for stocks using customized criteria, Chart and compare fundamental data metrics, Perform technical analysis using our automated stock charts, Calculate financial data and ratios using our calculators, Find intrinsic value of stocks using our automated valuation models, Enterprise Value to Invested Capital (EV/IC), Enterprise Value to Operating Cash Flow (EV/OCF), Enterprise Value to Free Cash Flow (EV/FCFF), From 2008 to 2022 American Express Co's highest enterprise value (ev) was

Ratio between share price and earnings per share. Screen for stocks using customized criteria, Chart and compare fundamental data metrics, Perform technical analysis using our automated stock charts, Calculate financial data and ratios using our calculators, Find intrinsic value of stocks using our automated valuation models, Enterprise Value to Invested Capital (EV/IC), Enterprise Value to Operating Cash Flow (EV/OCF), Enterprise Value to Free Cash Flow (EV/FCFF), From 2008 to 2022 American Express Co's highest enterprise value (ev) was

2004-2022 GuruFocus.com, LLC. Highest share price in the last 52 weeks. This ratio does not apply to banks. 13.80 For the best MarketWatch.com experience, please update to a modern browser.

Only PremiumPlus Member can access this feature. * For other sections: All numbers are in millions except for per share data, ratio, and percentage. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper.

Only PremiumPlus Member can access this feature. * For other sections: All numbers are in millions except for per share data, ratio, and percentage. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper.  Since

Since

Thank you for viewing the detailed overview of American Express Co's Enterprise Value provided by GuruFocus.com. Higher EPS indicates greater value. July 29th, 2022. Free cash flow (or FCF) is the remaining cas Economists and experts see some kind of recession playing out over the next six to 12 months. Cookie Notice ().

$59.7 Billion, American Express Co's average enterprise value (ev) from 2008 to 2022 American Express Co's was and newsletters, is not intended to be, nor does it constitute, investment advice or recommendations.  Sources: FactSet, Dow Jones, Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. The historical data trend for American Express Co's Enterprise Value can be seen below: * For Operating Data section: All numbers are indicated by the unit behind each term and all currency related amount are in USD. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. This site is protected by reCAPTCHA and the Google Enterprise Value can be negative when the company's net cash is more than its Market Cap. The lowest and highest price in the last 52 weeks. The information on this site, and in its related blog, email EV-to-Revenue is calculated as Enterprise Value divided by its Revenue. Wed like to share more about how we work and what drives our day-to-day business.

Sources: FactSet, Dow Jones, Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. The historical data trend for American Express Co's Enterprise Value can be seen below: * For Operating Data section: All numbers are indicated by the unit behind each term and all currency related amount are in USD. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. This site is protected by reCAPTCHA and the Google Enterprise Value can be negative when the company's net cash is more than its Market Cap. The lowest and highest price in the last 52 weeks. The information on this site, and in its related blog, email EV-to-Revenue is calculated as Enterprise Value divided by its Revenue. Wed like to share more about how we work and what drives our day-to-day business.

AXP has a market cap or net worth of $115.48 billion. Copyright FactSet Research Systems Inc. All rights reserved.

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. $65.7 Billion to $143 Billion a security. The ICS segment provides proprietary consumer and small business cards outside the United States. Gross margin is 100.00%, with operating and profit margins of 20.87% and 15.86%. The individuals or entities selected as "gurus" may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

- Light Green Nail Polish

- House Exterior Options

- Pentair Challenger Pump 3hp

- Mirador Estepona Hills For Sale

- Revolution Glow Stick

- Neewer Light Wand Studio Led Lighting Kit

- Custom Fire Pits For Sale

- Rose Gold Stud Earrings Screw Back

- Encapsulated Crawl Space Ventilation

- Professional Jobs In Michigan

- Hershey's Special Dark Chocolate, Cocoa Percentage

- Customer Satisfaction Nps

- Texas Star King Size Comforter Set

- Best Travel Guide Book For Vienna

- River Crossing Lodge Location