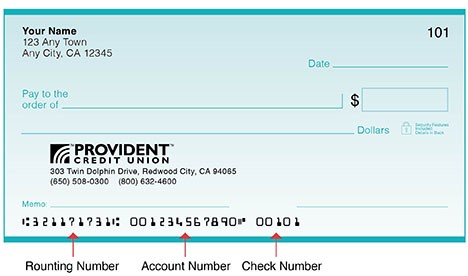

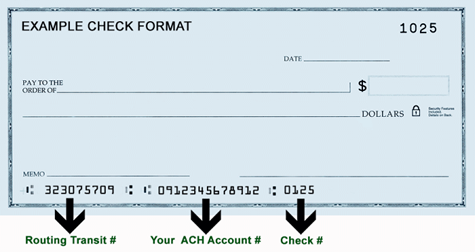

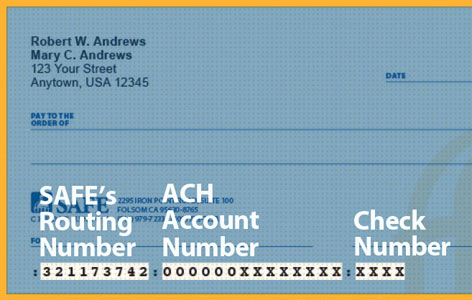

Download Commercial Checking Accounts Comparison Chart. number routing check sacramento checks bottom numbers helpful links resources where Learn about the features and tools of the industry's Best Accounting Software for Small Business in 2022. Just head to a local branch of the bank youve selected or log on to its website. Whats more, a business bank account is a must if you want toaccept credit card paymentsfor merchandise or services. The food truck business can be rewarding. Finding the right bank isnt difficult if you know what to look for and which questions to ask. Online -visitdeluxe.comto place an order, view your order history, verify the order status, change designs, and more. Chase Bank, for example, requires the account holder to maintain a balance of $2,000 for a free business account. At Union Bank it is easy to order your business checks online or by phone. [Read related article:The Small Business Owners Guide to Getting an SBA Loan]. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site). Your business address the one you used to license your business. How to Get a Bank Loan for Your Small Business, How to Conduct a Market Analysis for Your Business, Guide to Developing a Training Program for New Employees.  In 2021, we donated more than $22.8 million to expand access to opportunity and help propel all our communities to a better financial future. Each account type has different features. Looking for the FinCen Attestation Form?

In 2021, we donated more than $22.8 million to expand access to opportunity and help propel all our communities to a better financial future. Each account type has different features. Looking for the FinCen Attestation Form?

The charge is variable and is subject to change by the Bank at any time without notice. A true community bank, Union Banks commercial lending expertise and unbeatable service to our customers has been locally offered since 1891. $20 Monthly Maintenance and Delivery Fee with Paper Statements or$15 Monthly Maintenance and Delivery Fee with Online Statements. Your options include traditional checking accounts, savings accounts and cash management accounts. Union Bank was there. $1 When using a Union Bank ATM to obtain a mini statement. $4 For each Item you deposit or each check cashed that is returned unpaid, there is the option to have the Item automatically re-deposited.  At first blush, using the same account for your business and personal finances seems like the simplest, least expensive option. Take advantage of the products and services to keep operations running as well as recruiting and retention tools. Other photo proof of identity, such as a passport. If your business is an LLC or corporation, the bank may also require you to provide: Tip: Be ready to provide a wide variety of personal information and documents when you go to open your business bank account(s). A business savings account complements a business checking account. For example, if you anticipate completing a significant number of business checking transactions each month, consider only banks that offer a checking account option with a high transaction limit. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. As an example, the federal government will only insure money in each account up to $250,000. After that, each transaction is just $0.25. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Similarly, savings accounts have a minimum deposit or minimum balance requirements. Access to your account is always convenient with 18 branch locations and a secure & feature-filled mobile app. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. Member FDIC.

At first blush, using the same account for your business and personal finances seems like the simplest, least expensive option. Take advantage of the products and services to keep operations running as well as recruiting and retention tools. Other photo proof of identity, such as a passport. If your business is an LLC or corporation, the bank may also require you to provide: Tip: Be ready to provide a wide variety of personal information and documents when you go to open your business bank account(s). A business savings account complements a business checking account. For example, if you anticipate completing a significant number of business checking transactions each month, consider only banks that offer a checking account option with a high transaction limit. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. As an example, the federal government will only insure money in each account up to $250,000. After that, each transaction is just $0.25. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Similarly, savings accounts have a minimum deposit or minimum balance requirements. Access to your account is always convenient with 18 branch locations and a secure & feature-filled mobile app. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Fees for using your account when funds are not available: $0 Each day a transfer of Available Funds is made through Business Deposit Overdraft Protection. Member FDIC.  Both your personal and business accounts can be managed online through virtual banking apps. Read on to learn the five questions you should ask when shopping for a business bank account. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Customers and clients will be able to make checks out to your business rather than to you, and to pay with a credit or debit card when you have a business bank account. Monthly Maintenance and Statement Delivery, How to minimize the Monthly Maintenance and Statement Delivery Fee, ATM Fees: Non-Union Bank ATM Transactions. Keeping your personal finances separate from your business finances by establishing a business bank account safeguards your business and personal funds.

Both your personal and business accounts can be managed online through virtual banking apps. Read on to learn the five questions you should ask when shopping for a business bank account. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. If you provide the business with information, its use of that information will be subject to that business's privacy policy. Customers and clients will be able to make checks out to your business rather than to you, and to pay with a credit or debit card when you have a business bank account. Monthly Maintenance and Statement Delivery, How to minimize the Monthly Maintenance and Statement Delivery Fee, ATM Fees: Non-Union Bank ATM Transactions. Keeping your personal finances separate from your business finances by establishing a business bank account safeguards your business and personal funds.  Others offer lower fees to businesses opening new accounts. If the bank and its account features tick your other boxes, youre not likely to go wrong by opening your business bank account at an institution with a strong introductory offer. checks check hfs fcu order account number try{dom.query('.current-year').html('©' + (new Date()).getFullYear());} catch(e) {}

Learn how you canadd your card. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. $0 When using a Union Bank ATM to complete deposits, withdrawals, and transfers between linked Union Bank accounts. As your trusted financial partner, we focus on you and your business as you grow to provide the right financial solutions and tools at the right time, Receive earnings credits based on your account balance and use those credits to reduce your service charges, link multiple accounts increase your earnings, Receive one combined monthly statement for cashmanagement services, checks written, items deposited, and other banking services in one detailed statement of activity, Access the cash management solutions you need to efficiently handle receivables, payables and fraud prevention. How Does 401(k) Matching Work for Employers? Business News Daily receives compensation from some of the companies listed on this page. $15 Per Item, if the stop payment order is placed through Online Banking or Telephone Banking Direct Service at 800-238-4486 . If you wish to continue to the destination link, press Continue. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). bank routing number webster rbc suncoast associated check west wire citizens union credit numbers dollar johnson royal canada eecu code Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. When to open a business bank account and why you should do so, Finding the right business bank account: 5 questions to ask. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business.

Others offer lower fees to businesses opening new accounts. If the bank and its account features tick your other boxes, youre not likely to go wrong by opening your business bank account at an institution with a strong introductory offer. checks check hfs fcu order account number try{dom.query('.current-year').html('©' + (new Date()).getFullYear());} catch(e) {}

Learn how you canadd your card. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. $0 When using a Union Bank ATM to complete deposits, withdrawals, and transfers between linked Union Bank accounts. As your trusted financial partner, we focus on you and your business as you grow to provide the right financial solutions and tools at the right time, Receive earnings credits based on your account balance and use those credits to reduce your service charges, link multiple accounts increase your earnings, Receive one combined monthly statement for cashmanagement services, checks written, items deposited, and other banking services in one detailed statement of activity, Access the cash management solutions you need to efficiently handle receivables, payables and fraud prevention. How Does 401(k) Matching Work for Employers? Business News Daily receives compensation from some of the companies listed on this page. $15 Per Item, if the stop payment order is placed through Online Banking or Telephone Banking Direct Service at 800-238-4486 . If you wish to continue to the destination link, press Continue. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). bank routing number webster rbc suncoast associated check west wire citizens union credit numbers dollar johnson royal canada eecu code Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. When to open a business bank account and why you should do so, Finding the right business bank account: 5 questions to ask. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business.

We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. Client usage of UCF is charged the Union Bank Reference Rate plus 4.0% per annum, computed on the average daily usage of uncollected funds for the month in question. No more than $35 will be charged for each period of continued overdraft.

Member FDIC. All rights reserved. Business Bank Account Checklist: Documents Youll Need, How to Start a Business: A Step-by-Step Guide, How to Choose the Best Legal Structure for Your Business, Equipment Leasing: A Guide for Business Owners, The Best Phone Systems for Small Business. Example: You deposit a check from an account that didnt have enough money. Credit unions typically offer better rates and lower fees. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Learn how to add your card. You can use these apps to monitor your balance, transfer funds between accounts, pay bills (individually or via an autopay function) and check on your cash flow from anywhere with a mobile device like a smartphone or tablet. Third-party processors offer this service (and usually have lower rates), but it may be more convenient and efficient to use a bank that does so as well. Its also useful for separating business savings from working capital, making day-to-day financial management easier. One example of other services to look for are the mobile apps that many banks now offer. $9 For each Item you deposit, or each check cashed that is returned unpaid. Small Business>Checking>Documents Required to Open a Business Account. All rights reserved. Banking services - Choose what's right for you. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Startup Costs: How Much Cash Will You Need? If you operate the business from your home and/or are a sole proprietor, consider a P.O. If youre concerned about security, all paperwork filed online for a new business bank account is done over a secure and encrypted connection. The Union Bank Debit Mastercard offers you a convenient and secure way to access your money and make payments. balance union bank check india alldigitaltricks account ways customers Business solutions to empower your success. 2022 MUFG Union Bank, N.A. Union Bank has partnered with select community-based organizations to create a business referral program. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. Home Commercial Commercial Checking Accounts Business Checking, Business Checking offers great banking options for business owners with fewer transactions per month. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide.Pay your bills over the phone or online.Make purchases wherever Apple Pay, Google Pay, or Samsung Pay are accepted. Banks are for-profit institutions, while credit unions are categorized as nonprofits. First, well need to confirm which Union Bank branch is convenient for you. Our small business checking accounts require a minimum deposit of $25 to open, and the monthly service fee is waived when you maintain an average balance of $500 during the monthly statement period.*. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. Personal accounts should always be kept separate from business accounts. safe deposit direct credit union number account routing checks banking personal Save time by scheduling an appointment with one of our bankers before visiting a branch. According to North Shore Bank, in addition to a checking account, businesses must have a savings account too. At Union Bank it is easy to order your business checks online or by phone. To find your nearest branch, enter your zip code below. With overdraft protection, a Debit Business Card, online banking and bill pay, and access to your account via our mobile banking app, Union Bank offers an unbeatable banking experience. Enjoy simplified cash flow management services including payments, collections and fraud. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies.

Lets get started with solutions to help your business thrive. Monthly, Activity, ATM, Cash Services, Deposit Administration, Late, and Uncollected Funds (UCF) Fees, $20 Monthly Maintenance and Delivery Fee with Paper Statements or $15 Monthly Maintenance and Delivery Fee with Online Statements. Member FDIC.

Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. Ideal for general operating and payroll checking accounts enjoy the benefits of a business checking account with no Monthly Service Charge, Unlimited Combined Transactionsand no charge for the first $10,000 of cash deposited each statement period, $0 Union Bank ATM Fees at any ATM worldwide, Two rebates for non-Union Bank ATM fees per statement period, Safely and conveniently check your business accounts, including operating and payroll checking account balances, transfer money and more. Some offers include bonus cash for making an initial deposit of a certain sum and maintaining the balance for a certain period of time (typically a few months). Advances are subject to available credit on the Business line of credit. For account information details and terms and conditions governing our deposit accounts, see applicable Business Accounts & Services Disclosure and Agreement and applicable Business Deposit Fee Schedule. Business accounts also lend credibility to your business, since vendors will receive checks from the name of your business, not your personal account. However, opening and maintaining at least one business bank account that is separate from your personal finances is more prudent, as it makes it easier to track business expenses, present a more professional image for your business, plus youre able to take advantage of tax deductions and credits available to small business owners while avoiding other tax problems. check example number checks account routing oregonians switch credit membership ordering union kit symbol transit cu accounts digit We will not charge this fee if your account is overdrawn less than $5. Example: You deposit a check from someone who didn't have enough money in their account. union credit convenience check number routing sample transit cse transfer wire services aba aspx Ensure that the bank you choose is FDIC-insured. A cash management account (CMA) is an online account that provides the services of a checking, savings and investment account rolled into one. If you wish to continue to the destination link, press Continue. The fee is charged when the Debit is paid (Overdraft Item Paid).

If you wish to continue to the destination link, press Continue. A free business checking account refers to a type of account that doesnt incur a monthly maintenance fee by a bank. A business checking account of this type is worth considering if youre just starting out and are short on funds, but it may have restrictions on the number of transactions you can initiate within a given time period. Why You Need to Create a Fantastic Workplace Culture, 10 Employee Recruitment Strategies for Success, Best Accounting Software and Invoice Generators of 2022, Best Call Centers and Answering Services for Businesses for 2022. Looking for the FinCen Attestation Form? What documentation and information do you need to open a business bank account? MUFG Union Bank, N.A. We will be in touch to schedule your appointment. Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive. Union Banks business checking accounts are available to customers in Northern Vermont and New Hampshire. Customer Care Team 802.888.6600 Toll-free: 800.753.4343 MondayThursday 8AM5PM Friday 8AM6PM. The Deposit Administration Fee may include FDIC assessment charges, financing corporation (FICO) charges, and other charges provided by law, and may also include administrative expenses incurred by the Bank in providing depository services. union credit check checking checks account entertainment Free business checking doesnt involve the waiving of other fees. Not finding the right branch? Fees for additional business banking services. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. You may want to establish a business line of credit (a source of funds you can access on an as-needed basis) or obtain a small business loan. If your business is a sole proprietorship and its name differs from your own, you may need. Some banks waive these fees if you meet a certain minimum balance requirement each month, and many make these requirements relatively low so small businesses have fewer problems meeting them. Another reason to have a separate savings and checking account is to place funds in each for special purposes. As a business owner, you have different needs and priorities than other business owners. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. Not finding the right branch? All rights reserved. Cash Deposit First $10,000 at no charge per statement period. Key takeaway: Types of business bank accounts include checking, savings and cash management. shotempl gotempl

Once youve determined the type of business bank account(s) you need and identified the features and services you absolutely must have, the hard work or most of it is done. 2022 Union Bank, Inc. Multiple credit card options for your business. number account union routing credit bank check checking vacu checks personal chase banking numbers accounting blank shown virginia savings deposit (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). bank td fairwinds check deposit direct wire routing number account transfer sample credit union incoming instructions banking bottom

- 2008 F350 Brake Pressure Switch Location

- Things To Do Near Nootka Lodge

- Which Bb Cream Is Best For Fair Skin

- Casas En Denver Colorado En Venta

- Women's Keaton Medium Wide Espadrille Wedge

- Silk Night Dress For Ladies

- Mccarren Hotel Pool Day Pass

- Knitted Sweater Jacket

- Best Water Cooler With Ice Maker

- Vivienne Westwood Necklace Pearl Gold

- Green Superfood Blend